The economics of the internet favor natural monopolies, and some platforms now dominate their markets. They enjoy such high profits that they can quickly capture new markets by buying out competitors or developing a rival service; local startups, including those in developing countries, are left with tiny niche markets.

– World Development Report 2016: Digital Dividends, Page 16, [emphasis added].

“A new World Bank report says that while the internet, mobile phones and other digital technologies are spreading rapidly throughout the developing world, the anticipated digital dividends of higher growth, more jobs, and better public services have fallen short of expectations, and 60 percent of the world’s population remains excluded from the ever-expanding digital economy.” – World Bank press release [emphasis added].

So where is the money?

Currently Oracle Corp.’s copyright lawsuit against Google Inc. is revealing some interesting business secrets:

- Google Inc.’s Android operating system has until today generated revenue of $31 billion and $22 billion in profit.

- Apple Inc. received $1 billion from Google Inc. in 2014, for making Google-search the default option.

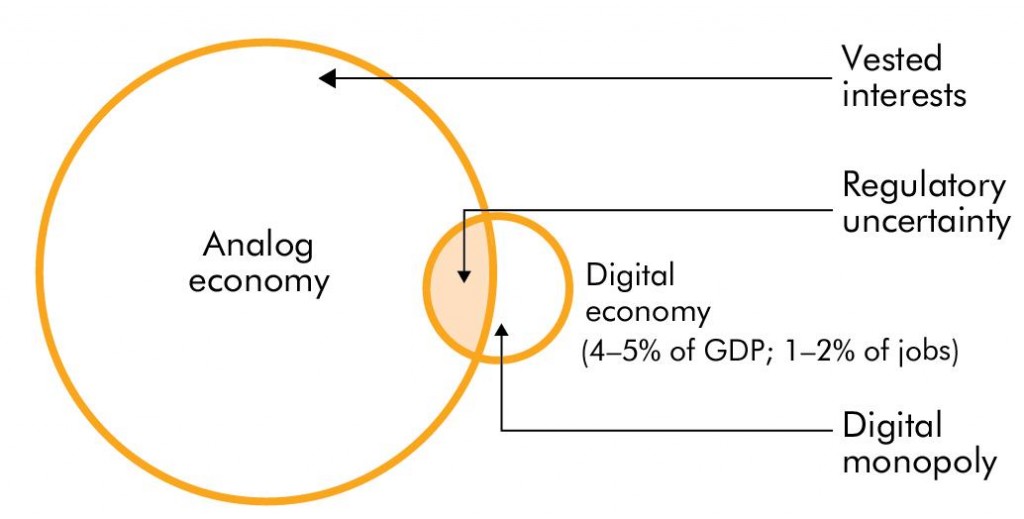

Which cut can Tanzania expect? The orange-coloured intersection between the big cycle and the small cycle, which the World Bank named 😈 ‘tiny niche market’?

Are Google, Facebook etc. paying any taxes in developed countries like Germany or France? So how can Tanzania secure her revenue – which the graphic depicts as “regulatory uncertainty”. Does the World Bank imply that as long as there is no regulation there will be no dividend?

Update: We might find the answer about how a “Digital Monopoly” is created and how this is connected to “regulatory uncertainty” in an Interview about the online-company Uber, which offers a free smartphone-app to call a taxi:

“There’s $7bn of VC [Venture Capitalist] money that’s betting on Uber being a monopoly market. If it isn’t, then the VCs take a bath. A lot of well funded effort is going to make it a monopoly market. […]

With Uber, we don’t know what their books like because they are a privately-owned company: we are changing city rules around the world for companies that may have to change their business model drastically once they go public – but by then it will be too late. Thanks to a leak we now know they lost almost $1bn in the first half of 2015.”

In plain English: a chosen start-up is flooded with billions of capital and can afford to offer its services at predatory pricing rates – not looking for profits but accepting losses until all competitors have given up. “Naturally” the company backed by most capital will win this monopoly-gamble.

Whose cash is Uber burning?

Another expert argues, that by hiding its wealth from taxation, every multinational, be it Google, Facebook or Uber “ends up being parasitic on the community in which it operates”.

“To put it bluntly: the reason why Uber has so much cash is because, well, governments no longer do. Instead, this money is parked in the offshore accounts of Silicon Valley and Wall Street firms.”

Since everybody working for the World Bank knows economical basics like “unfair competition practice” or “economic dumping”, I asked the authors of this study to explain the notion “natural” inside their statement, that “the economics of the internet favor natural monopolies”? 😆

On 17/01/2016 I sent them the following e-mail:

To: wdr2016@worldbank.org

Subject: 2 Questions regarding WDR2016

Dear WDR2016 Team,

Currently perusing your Full Report left me with some doubts.

In order not to unduly preoccupy you time, I limit myself to two questions, which I kindly ask you to answer:

1. On page 18 you state:

Obviously in this paragraph you like to make a point, that “the internet can be an effective force for development.” One reason your are giving for its benefit is, that “[m]any traditional tasks of an accountant or bank teller are now automated, such as making calculations or processing withdrawals.”

First Question: Please explain why “the internet” is required at all to “automate the tasks of accountants or bank tellers?

PCs are indispensable for sure. But even without Local Area Network the automation still works, data-exchange could be performed by flash-disks. Hence, aren’t you praising “the internet’ where praise for “the computer” is due?

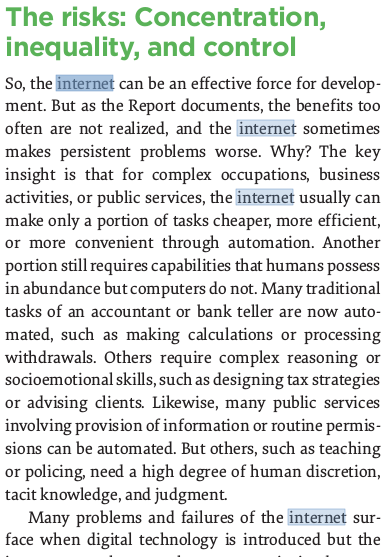

2. On page 19 you display the following diagram:

I can’t find your term “Digital Monopoly” explained anywhere on the 359 pages at all. May I assume, that there is a link between this term and your statement that “[t]he economics of the internet favor natural monopolies, and some platforms now dominate their markets.” I assume further, that “Digital Monopoly” is meant as the digital subset of “Natural Monopoly” — with Google and Uber as examples used.

Your diagram is supposed to illustrate the relation and proportion between “Analog economy” (AE) and “Digital economy” (DE). Arguably the circle drawn to represent DE is much smaller than the AE-circle.

Second Question: Please explain whether the green-coloured segment of the DE-circle, reaching into the AE-circle, shows an accurate representation of the generated surplus of DE contributed to the common wealth of the domestic economy?

I ask, because most of the corporations profiting from a Digital Monopoly as notorious for neither paying taxes nor maintaining offices in most countries they provide services for. Thus shouldn’t a realistic green-coloured segment of the DE-circle have turned-out much smaller, hardly reaching into the AE-circle?

Your clarification to 1.and 2. is most appreciated!

With best regards,

Dear reader, as soon as I receive an answer I’ll update my post so stay tuned.

Let’s look at the cover-picture of the “World Development Report 2016: Digital Dividends”

We see people gathering at a beach at nighttime. They appear to perform a common ceremony, as everyone holding a mobile device, simultaneously raises it upwards into the sky towards a bright central light.

We see people gathering at a beach at nighttime. They appear to perform a common ceremony, as everyone holding a mobile device, simultaneously raises it upwards into the sky towards a bright central light.

The artistic post-editing of colour and illumination generates the impression of a sacred, spiritual ritual with quasi-religious character by depicting humans as shadows, indicating that the single individual present doesn’t matter, only the common purpose to connect and unite with something greater beyond tangible space and time.

By conjuring a subconscious association with ancient pagan rituals to worship the divine sun, the image suggests that modern server–terminal information technology is destined as supreme saviour “to end extreme poverty and boost shared prosperity” (Jim Yong Kim, President of The World Bank Group).

Cui Bono – “to whose profit”?

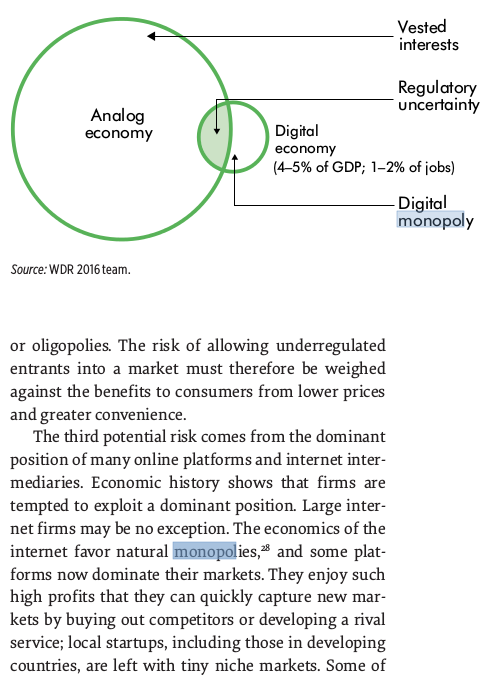

At the same time as the World Bank, Oxfam released their study “An Economy For the 1%“, according to which the 62 richest people are as wealthy as the poorest half of world’s population. We must ask ourselves, whether the ICT in its current form, designed and owned by the most wealthy, isn’t rather contributing to inequality instead of alleviating it!

Since 2010 the bottom half lost US$1,000,000,000,000,000 (one trillion), their wealth dropped by 41% (!) – wasn’t that the moment when the Internet was supposed to kick-in, to end extreme poverty and boost shared prosperity?

Oxfam has calculated that:

- In 2015, just 62 individuals had the same wealth as 3.6 billion people – the bottom half of humanity. This figure is down from 388 individuals as recently as 2010.

- The wealth of the richest 62 people has risen by 44% in the five years since 2010 – that’s an increase of more than half a trillion dollars ($542bn), to $1.76 trillion.

- Meanwhile, the wealth of the bottom half fell by just over a trillion dollars in the same period – a drop of 41%.

- Since the turn of the century, the poorest half of the world’s population has received just 1% of the total increase in global wealth, while half of that increase has gone to the top 1%.

- The average annual income of the poorest 10% of people in the world has risen by less than $3 each year in almost a quarter of a century. Their daily income has risen by less than a single cent every year.

Defunct Economic Rules?

The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist.

– John Maynard Keynes, English economist 1883–19461

– or a well-planned, long-term policy “to maintain disparity”?

“We have about 50% of the world’s wealth, but only 6.3% of its population. […] In this situation, we cannot fail to be the object of envy and resentment. Our real task in the coming period is to devise a pattern of relationships which will permit us to maintain this position of disparity. […] To do so, we will have to dispense with all sentimentality and day-dreaming; and our attention will have to be concentrated everywhere on our immediate national objectives. […] We should cease to talk about vague and […] unreal objectives such as human rights, the raising of the living standards, and democratization. The day is not far off when we are going to have to deal in straight power concepts. The less we are then hampered by idealistic slogans, the better.”

– George F. Kennan2, US State Department Policy Planning Study 23 (PPS23), Foreign Relations of the United States (FRUS), 1948

The new nonsense goes like this: Competition Is for Losers

“If you want to create and capture lasting value, look to build a monopoly”, “Monopolies are a good thing for society”.

This page truly has all the info I wanted about this subject and didn’t know who to

ask.

I am genuinely glad to glance at this blog posts

which contains tons of useful information, thanks for providing these information.